Income Tax

Reminder: This topic is only covered in MAT402.

Introduction

This chapter deals with the concepts of income tax. However, for this course we will only cover on the topic of personal income tax. By the end of this chapter, student should be able to:

- identify allowance deductions for income tax purposes,

- determine chargeable income,

- use the tax schedule to determine the tax amount,

- recognize that tax rebate is allowed for a chargeable income of less than RM35,000 and that zakat is an allowable rebate, and

- calculate tax payable.

Type of Assessment

Income tax is the normal tax which is paid on your taxable (chargeable) income.

Two types of Assessment:

- Separate Assessment, such that:

- Tax is calculated individually. For instance : bachelor, husband only, wife only.

- Husband the only one working (wife get relief and rebate).

- Children are assessed under husband unless it is requested by wife.

- Tax is calculated individually. For instance : bachelor, husband only, wife only.

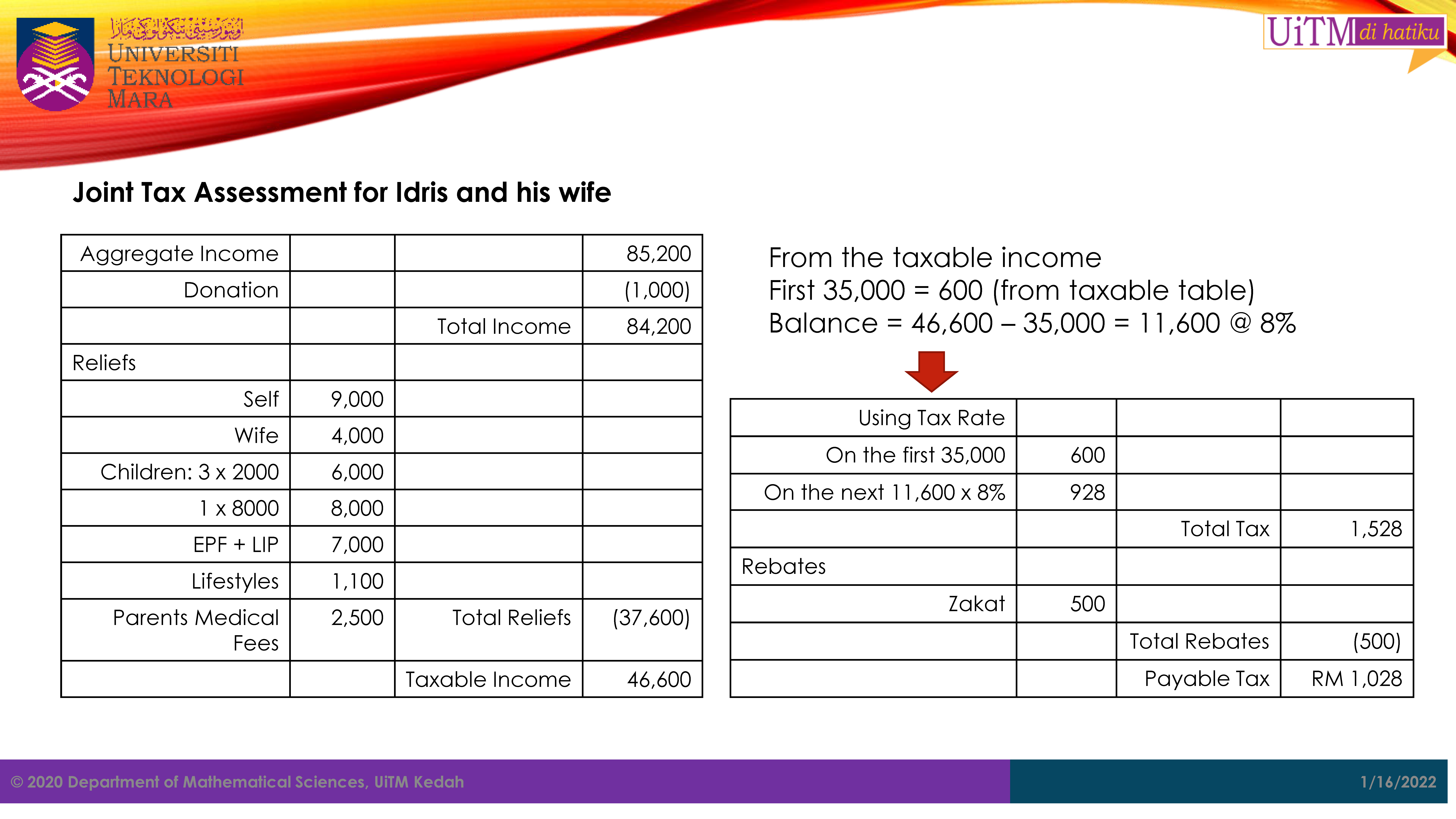

- Joint Assessment, such that:

- Tax is calculated together. For instance : husband + wife.

- For Parents Medical Expenses, only husband part is calculated.

- Tax is calculated together. For instance : husband + wife.

How to calculate tax payable amount?

To calculate tax payable amount, there are 5 steps:

1. Aggregate Income

- Annual Income (the salary for 12 months)

- For joint assessment, the aggregate income must be the combination income of husband and wife.

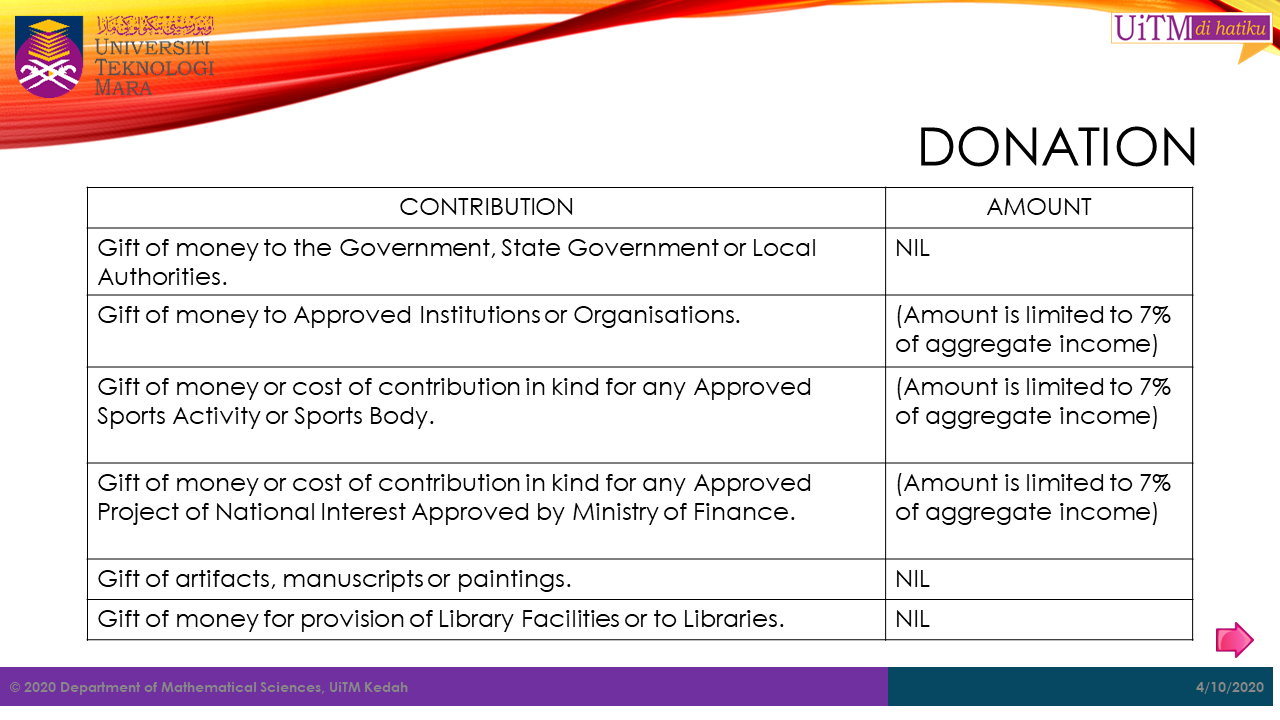

2. Donation

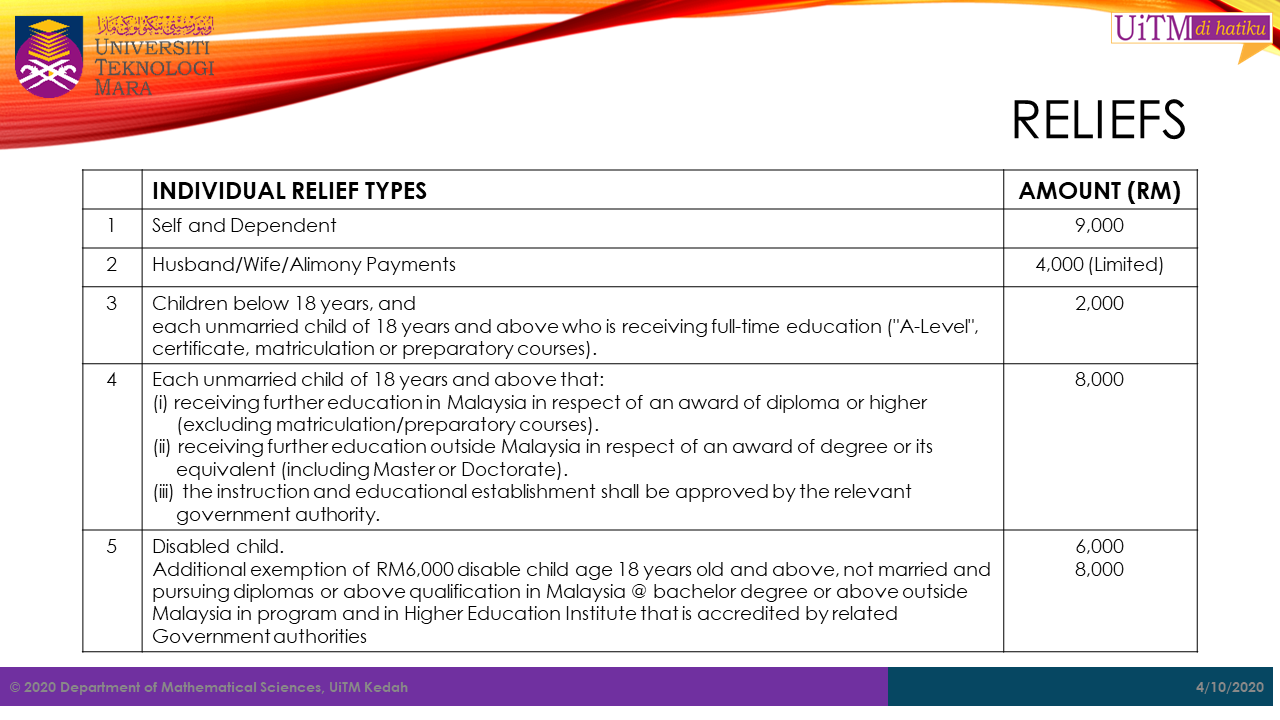

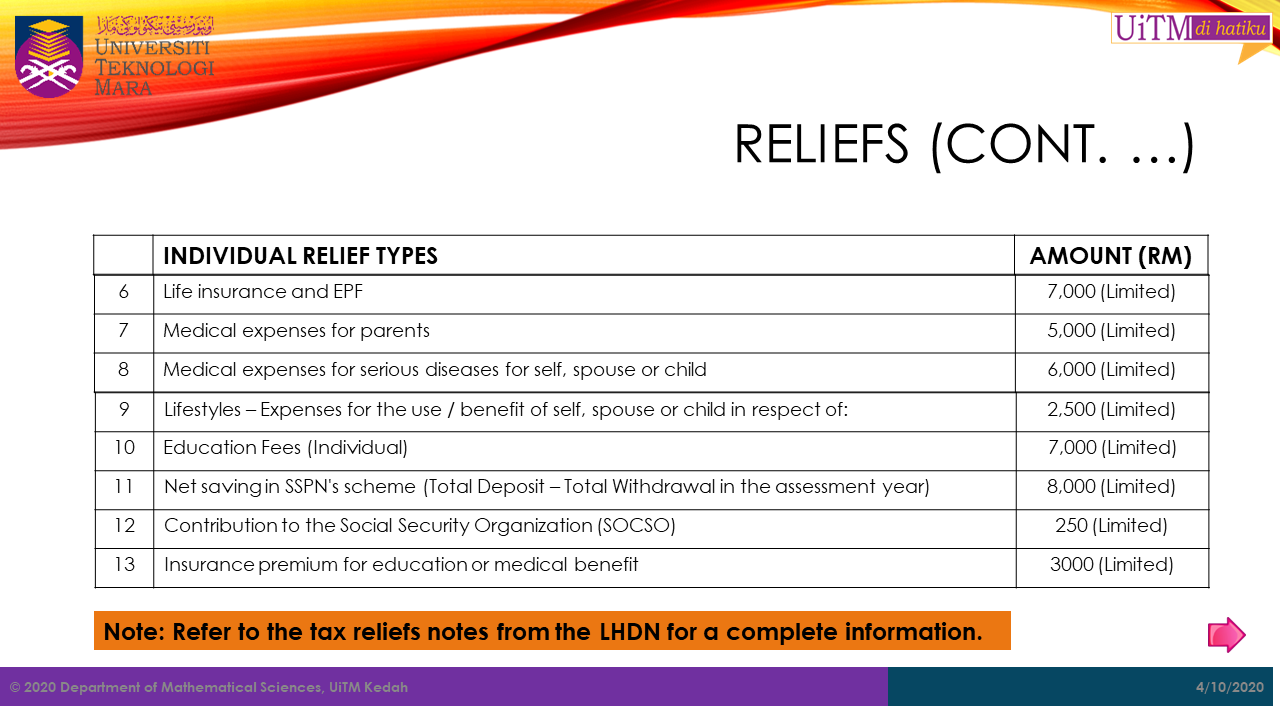

3. Reliefs

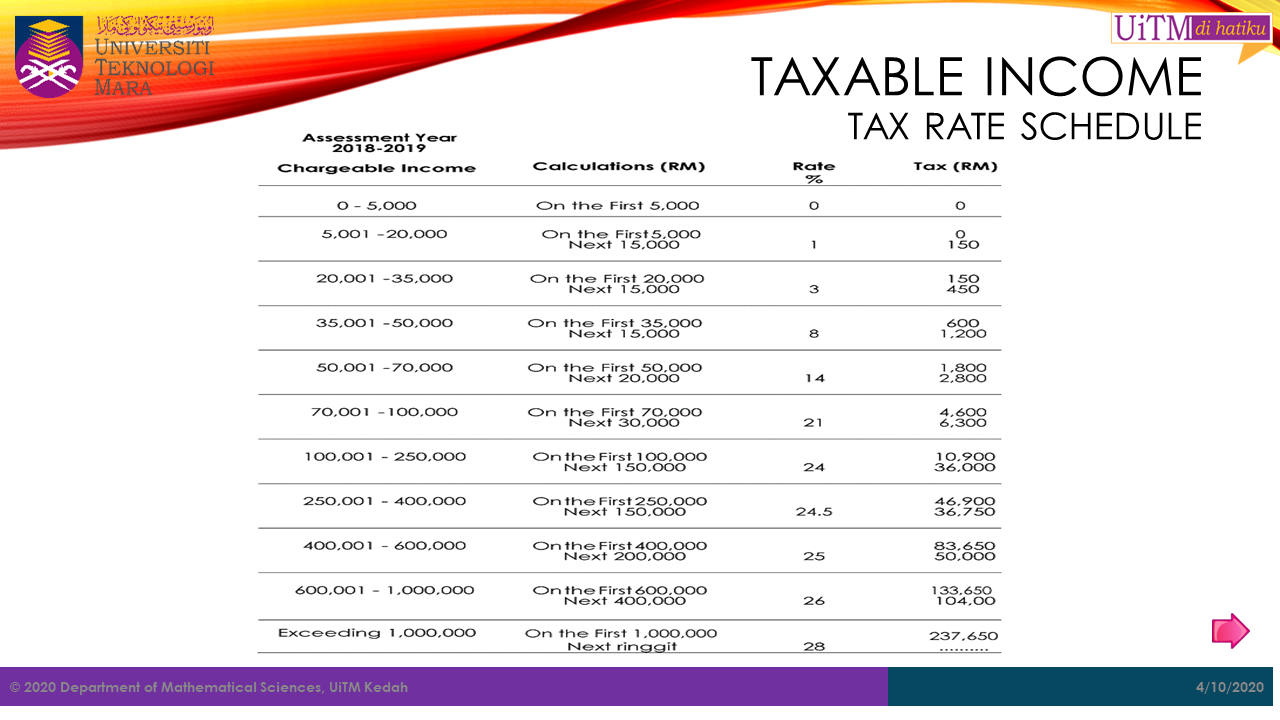

4. Taxable Income (Chargeable Income)

5. Rebates

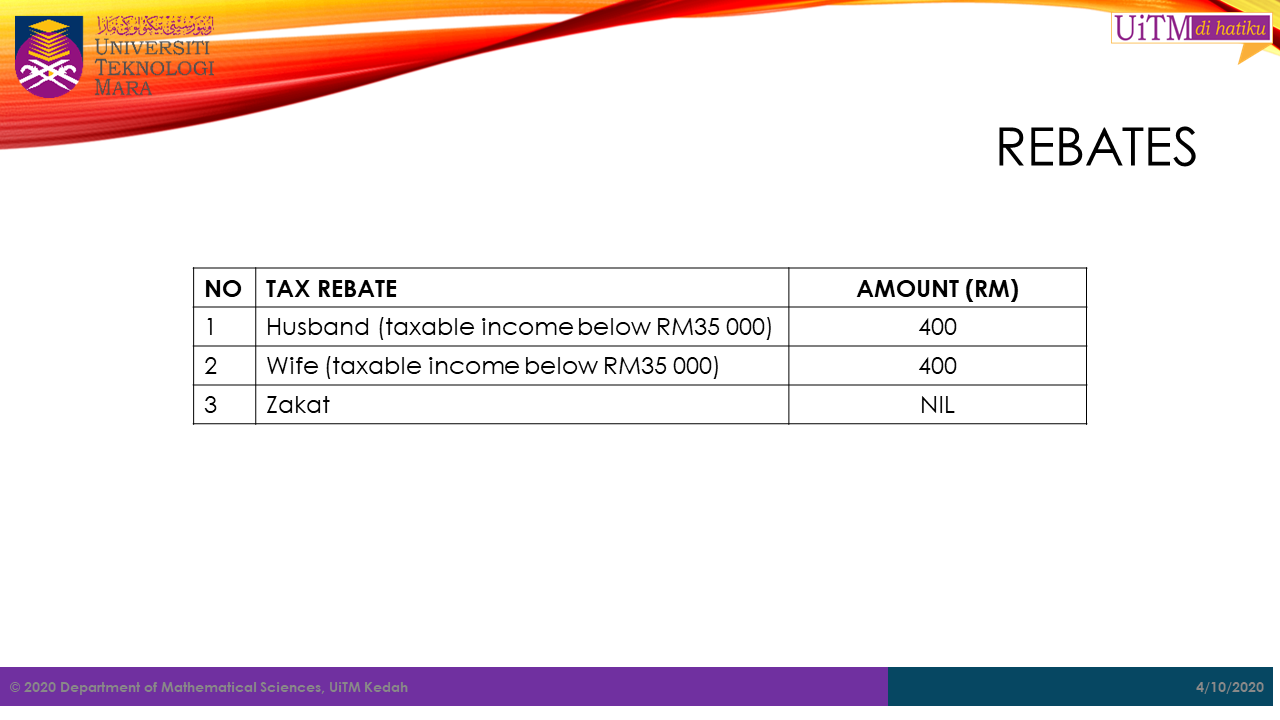

| No. | Tax Rebates | Amount (RM) |

|---|---|---|

| 1. | Husband (Taxable income below RM35,000) | 400 |

| 2. | Wife (Taxable income below RM35,000) | 400 |

| 3. | Zakat | No Limit |

Solved Examples

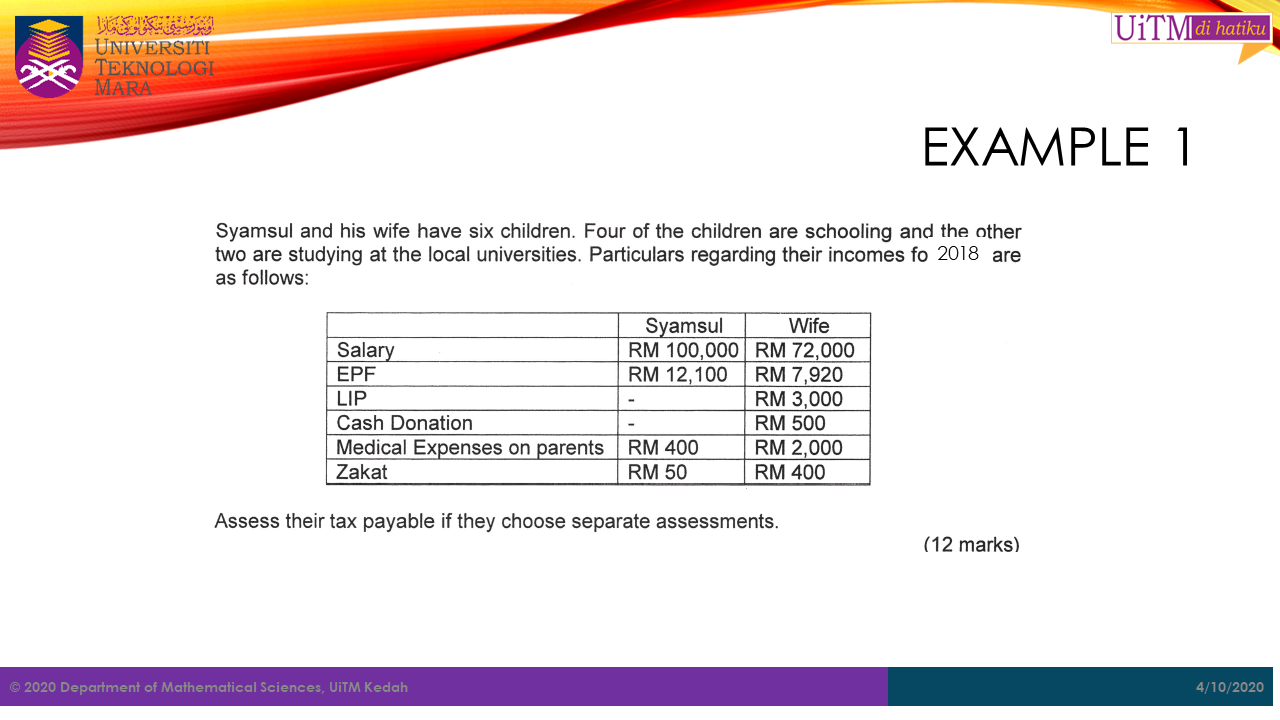

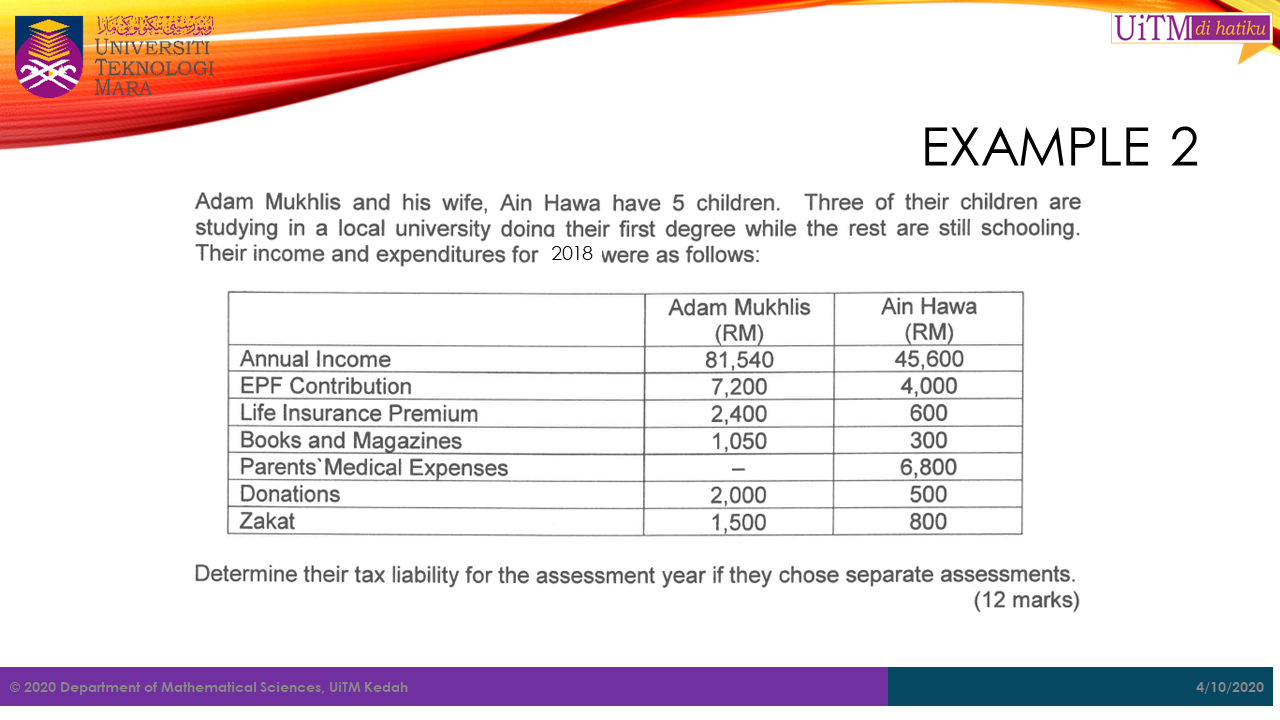

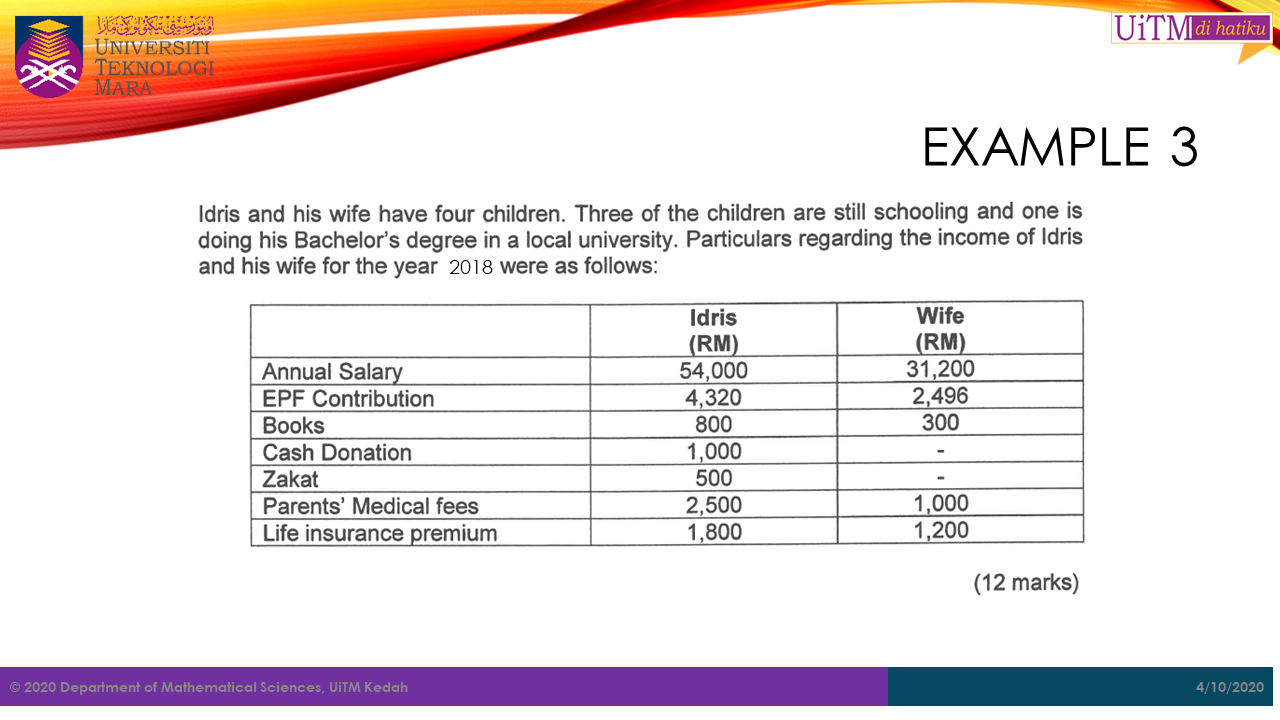

A couple with three children aged between 13 and 22 years old had a combined annual income of RM114,000 for the 2021 assessment year. The youngest daughter is studying in a secondary school and the rest are studying at a local university doing their diploma and bachelor’s degree. Their expenses (in RM) for the year 2021 are as follows:

| Husband | Wife | |

|---|---|---|

| Income | 75,000 | 39,000 |

| EPF Contributions | 9400 | 5500 |

| Life Insurance Premium | 1870 | 1390 |

| Parents Medical Bills | 2000 | |

| Zakat | 3000 | 2400 |

| Donations | 700 | 500 |

| SSPN | 2100 | 1200 |

Tax assessment for individual who is single

Tax assessment for individual who is married

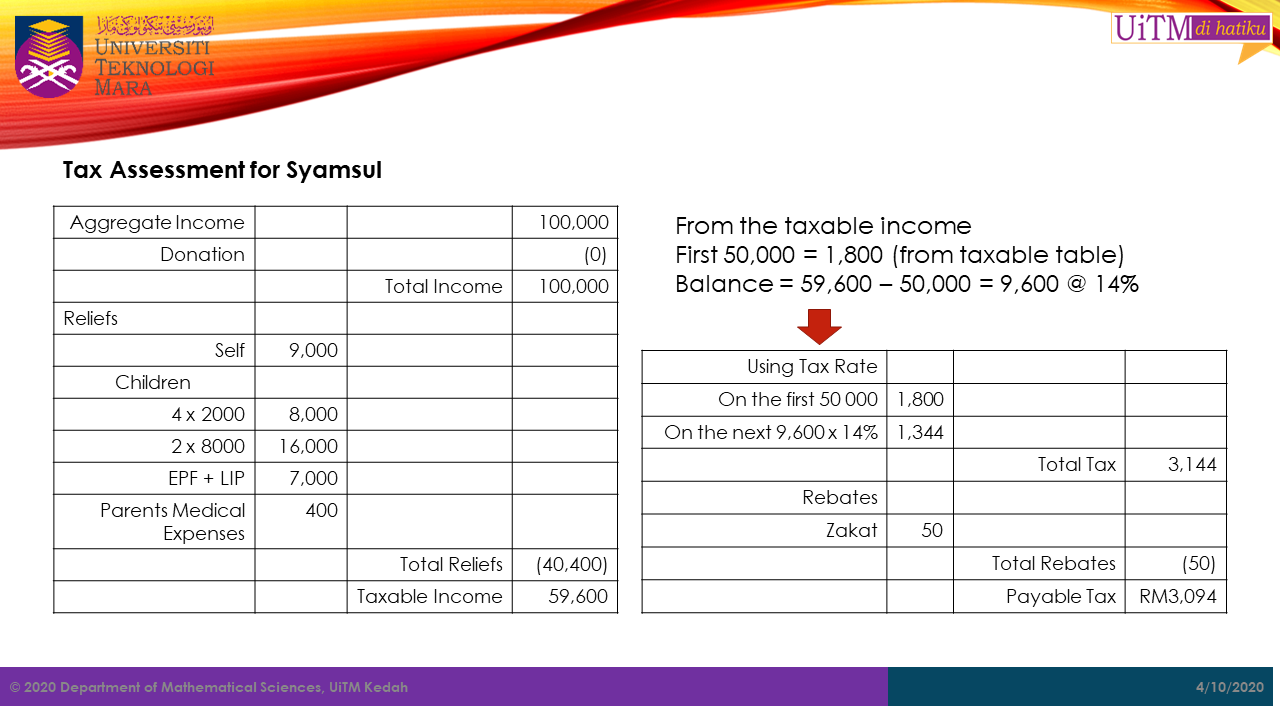

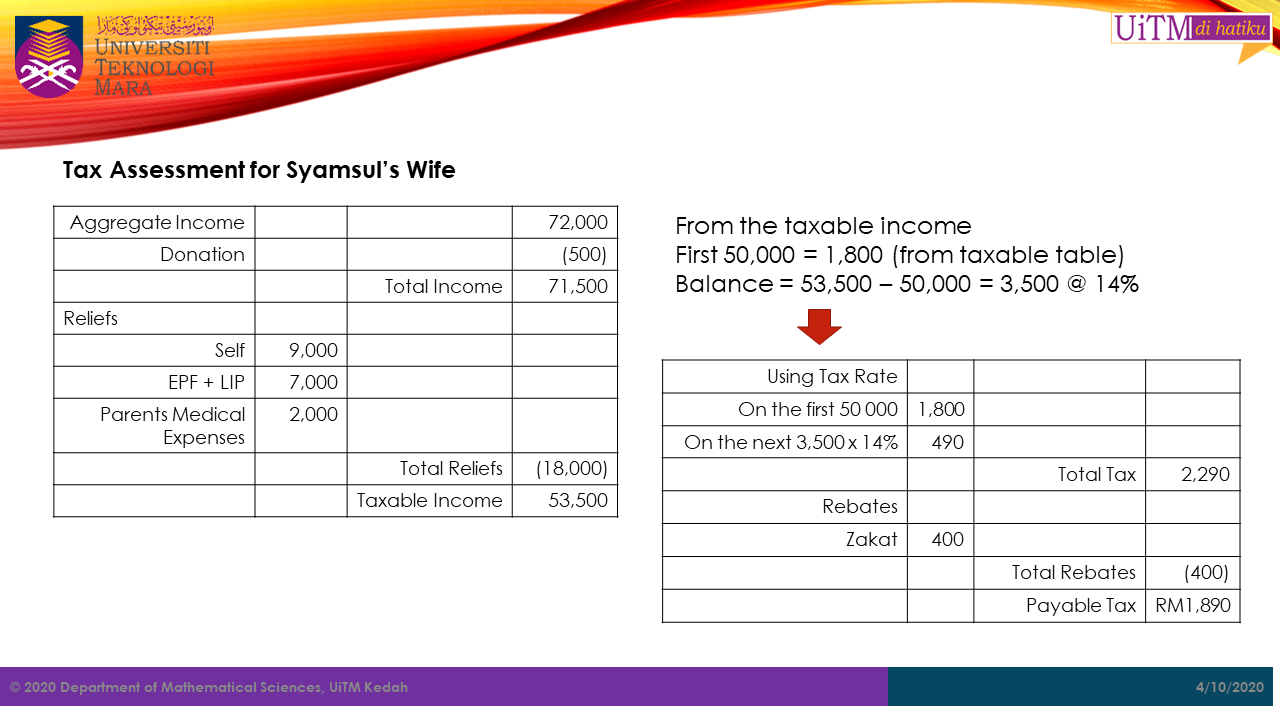

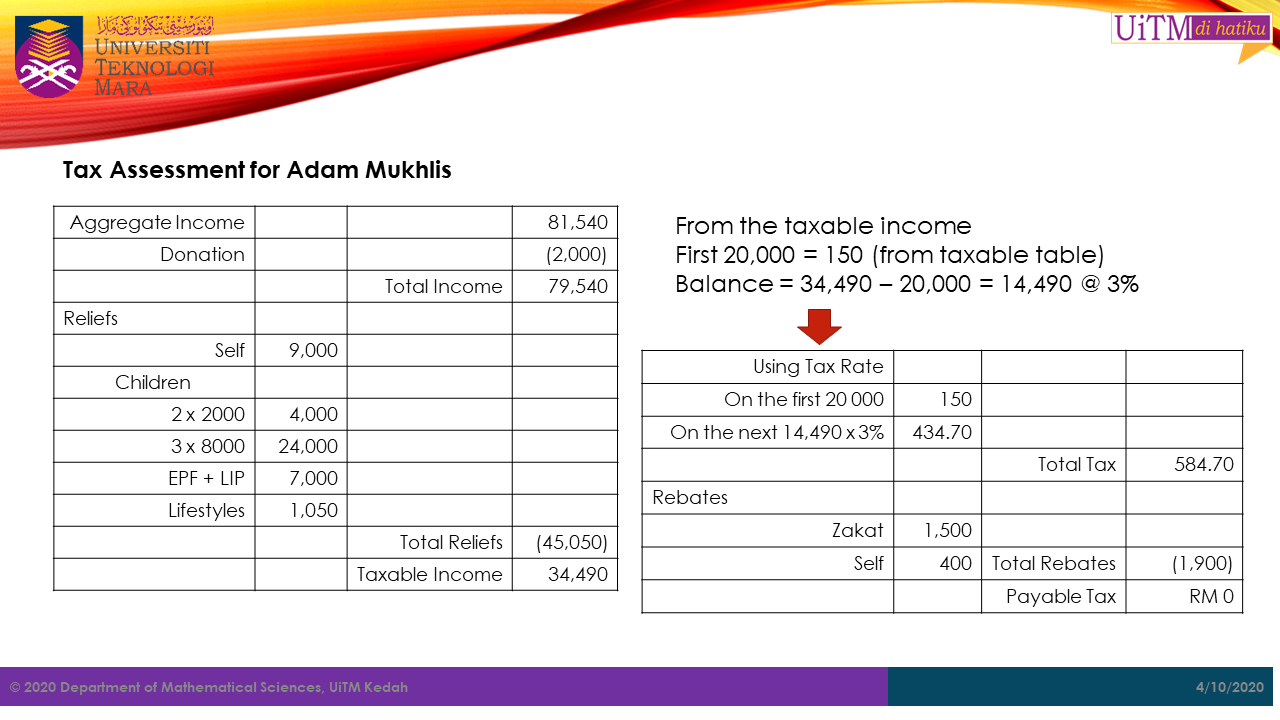

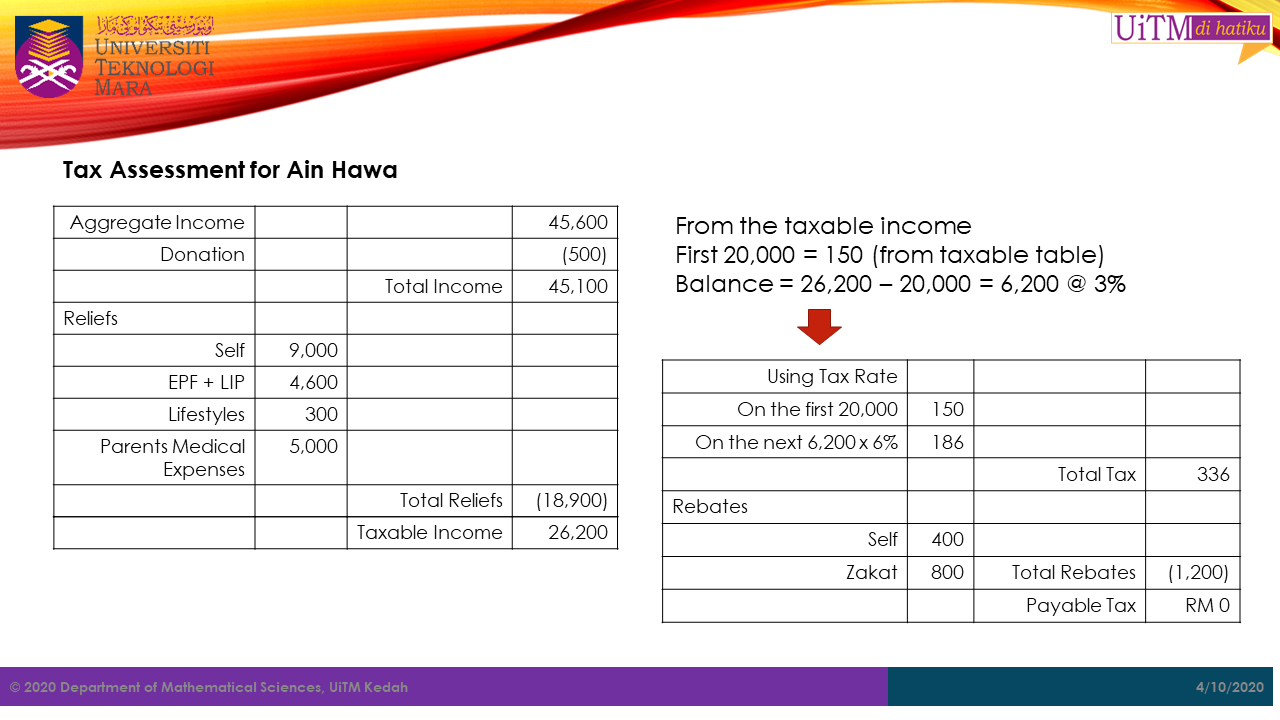

Separate Assessment

Joint Assessment