Annuity

Learning Outcomes

By the end of this chapter, student should be able to:

- find the future value of annuity,

- find the present value of annuity,

- solve for annuity payment, R, the number of payments, n, and the interest rate, I, and

- identify the problems where the present value and the future value of the annuity formula can be appropriately applied.

Introduction

An annuity is a sequence of payments made at regular time intervals. The time period in which these payments are made is called the term of the annuity while payment period is interval between annuity payments.

An annuity in which the payments are made at the end of each payment period is called an ordinary annuity An annuity in which the payment period coincides wit the interest compounding period is called a simple annuity.

Annuities considered here have terms given by fixed time intervals, periodic payments equal in size, payments made at the end of the payment periods, and payment periods coincide with the interest compounding period.

Example of annuity includes house rents, mortgage payments, instalment payments on automobiles, and interest payments on money invested.

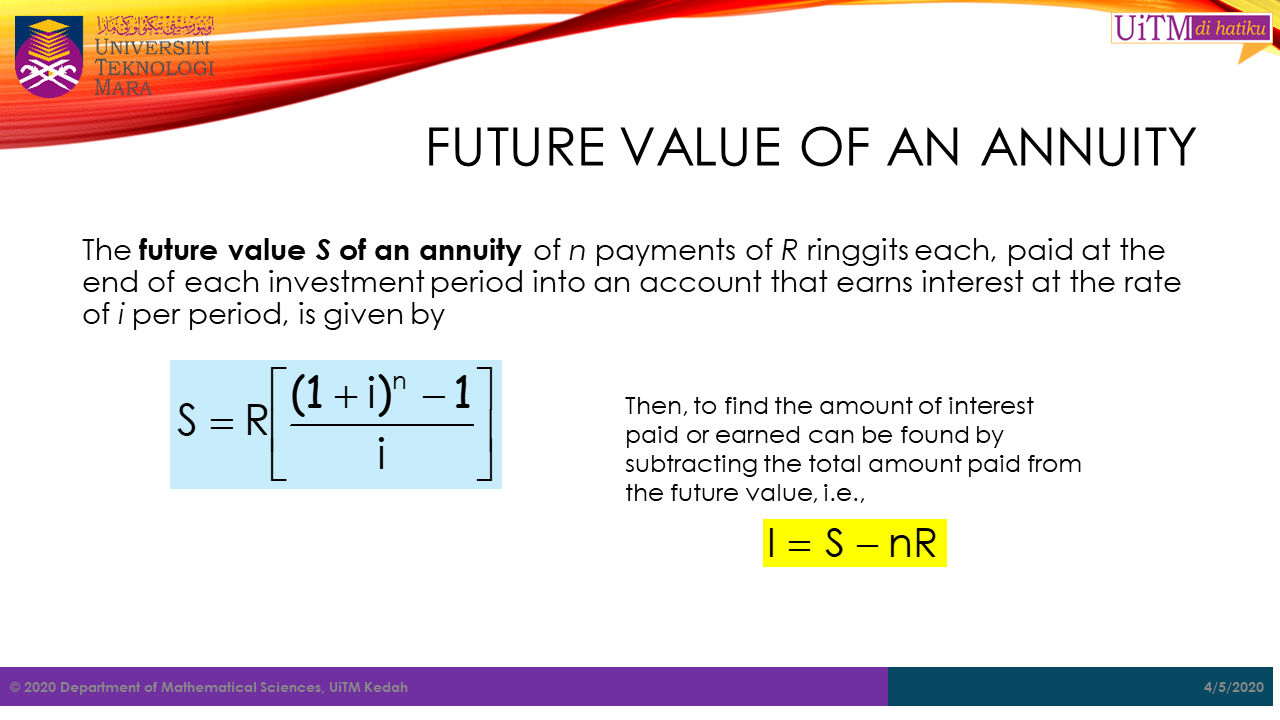

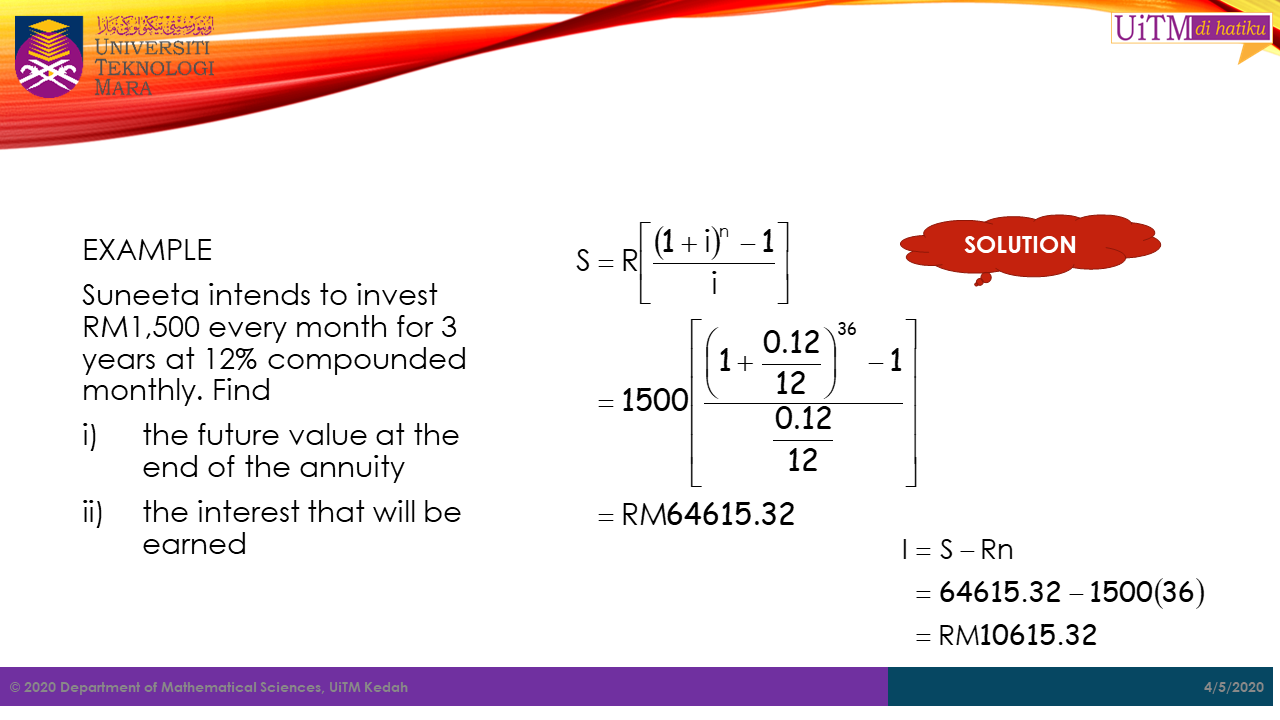

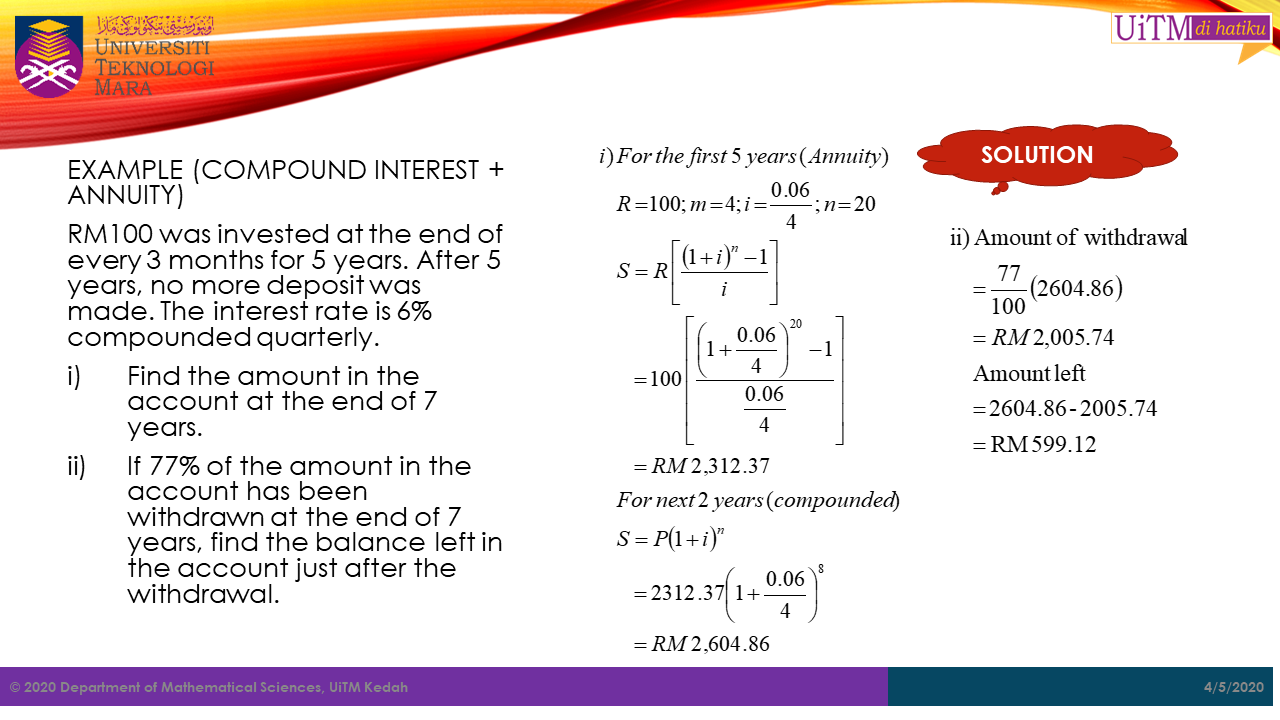

Future Value of an Annuity

The future value

Then, to find the amount of interest paid or earned can be found by subtracting the total amount paid from the future value, i.e.,

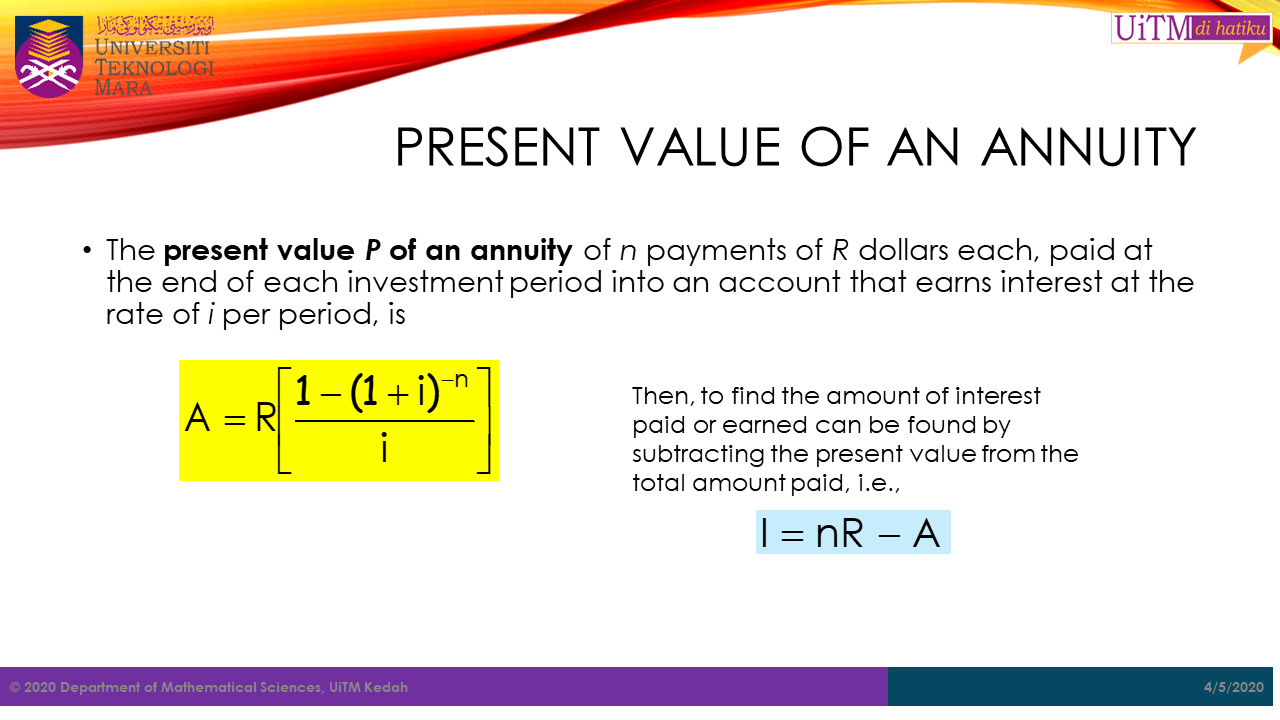

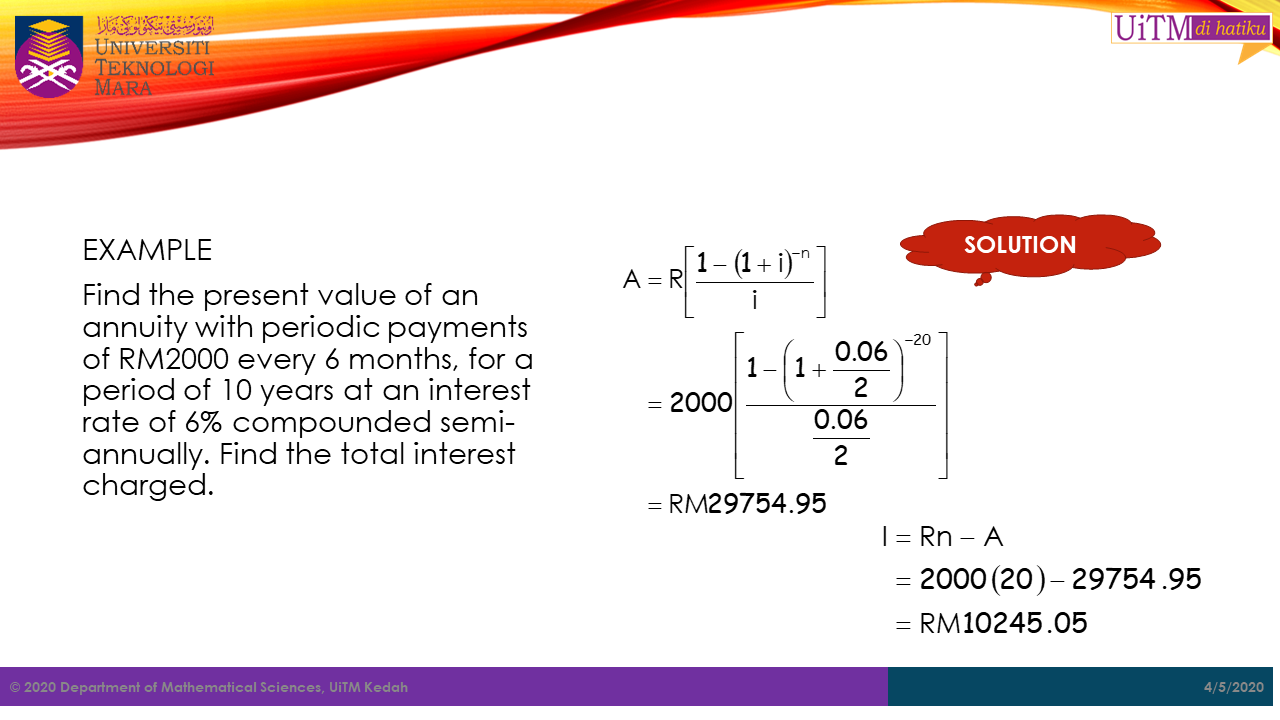

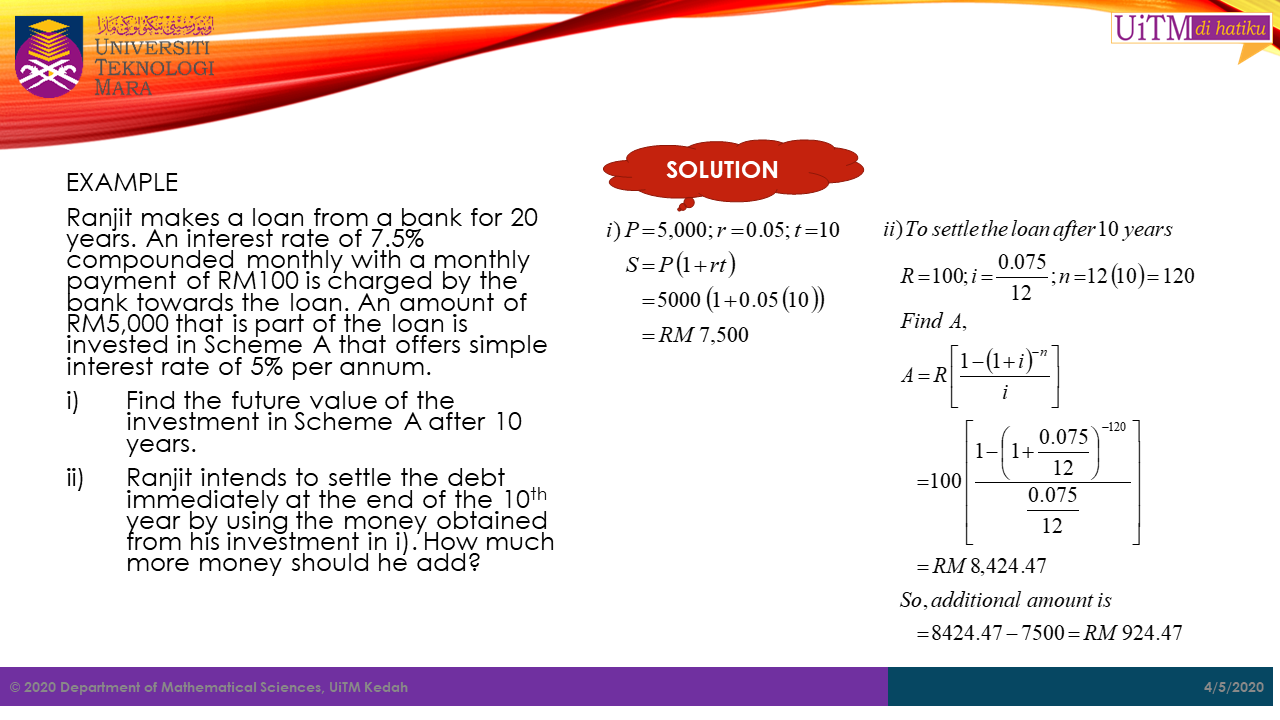

Present Value of an Annuity

The present value

Then, to find the amount of interest paid or earned can be found by subtracting the present value from the total amount paid, i.e.,

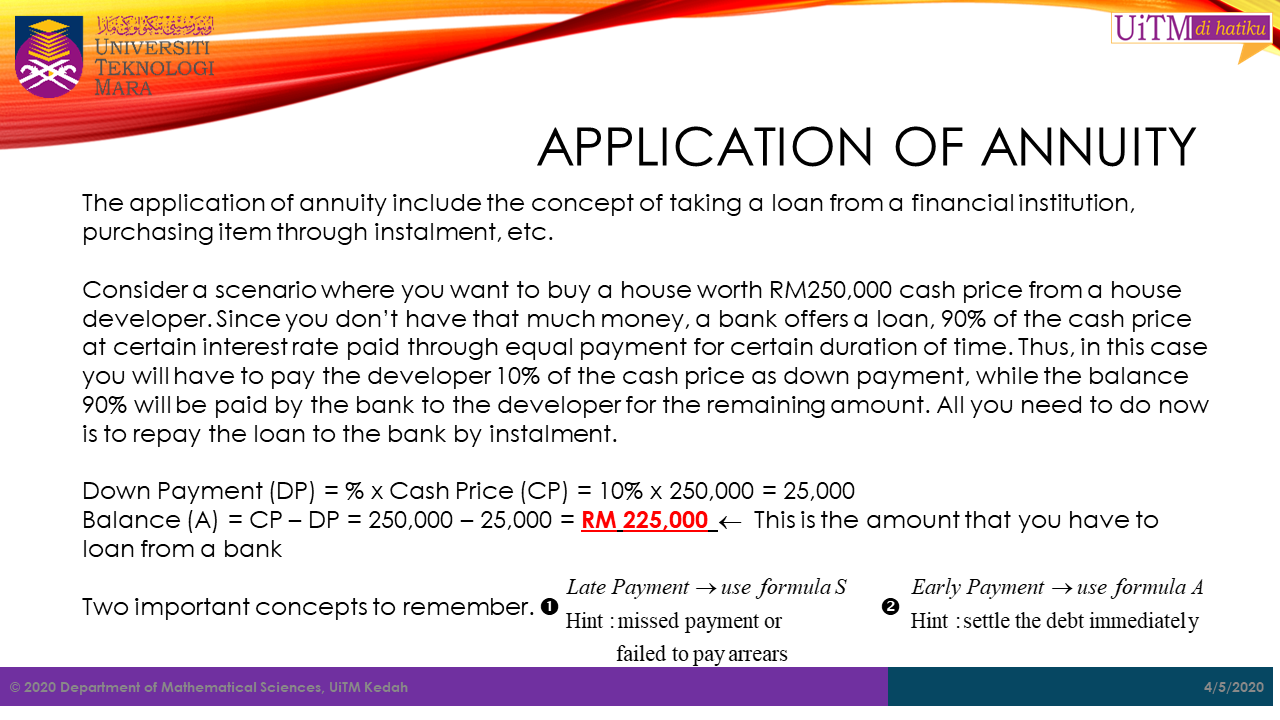

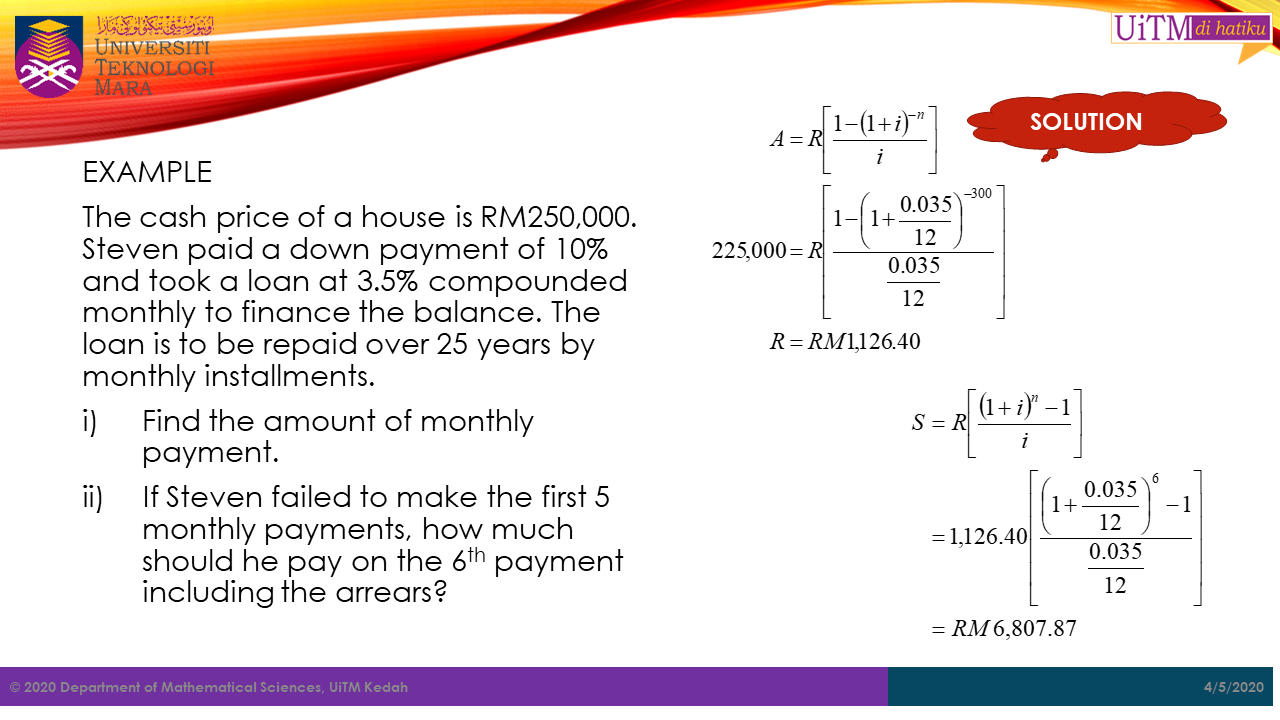

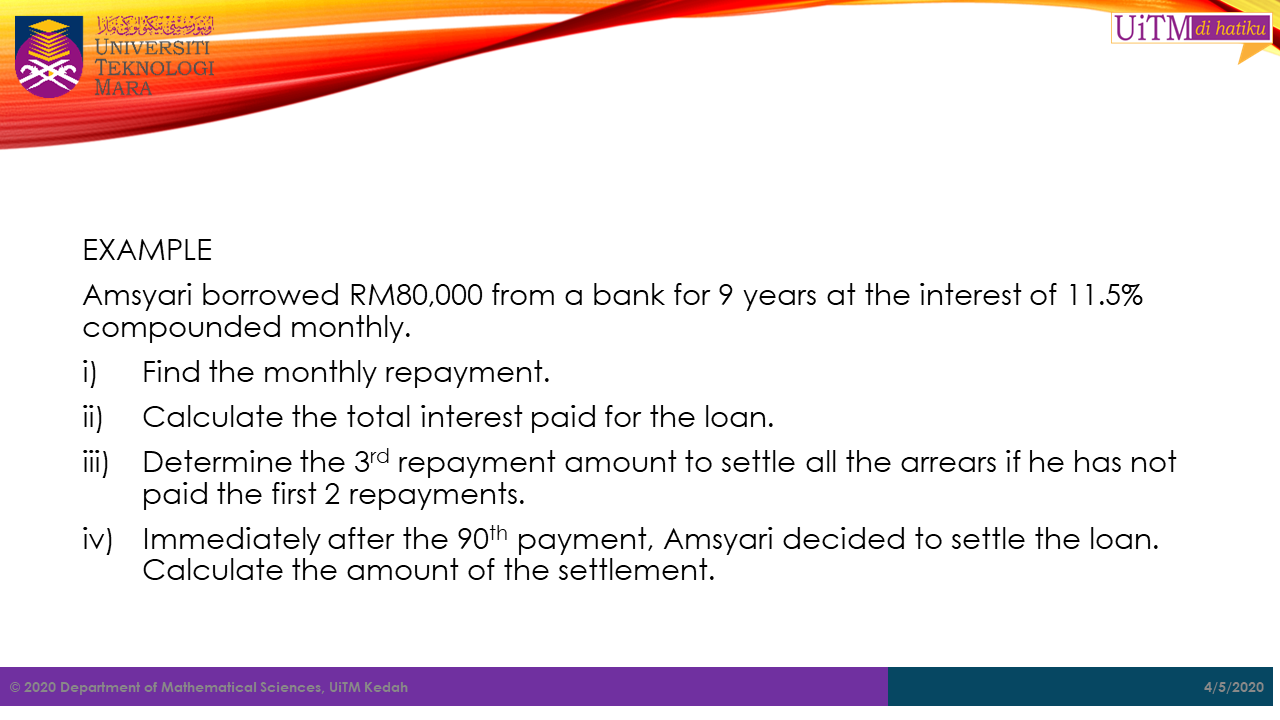

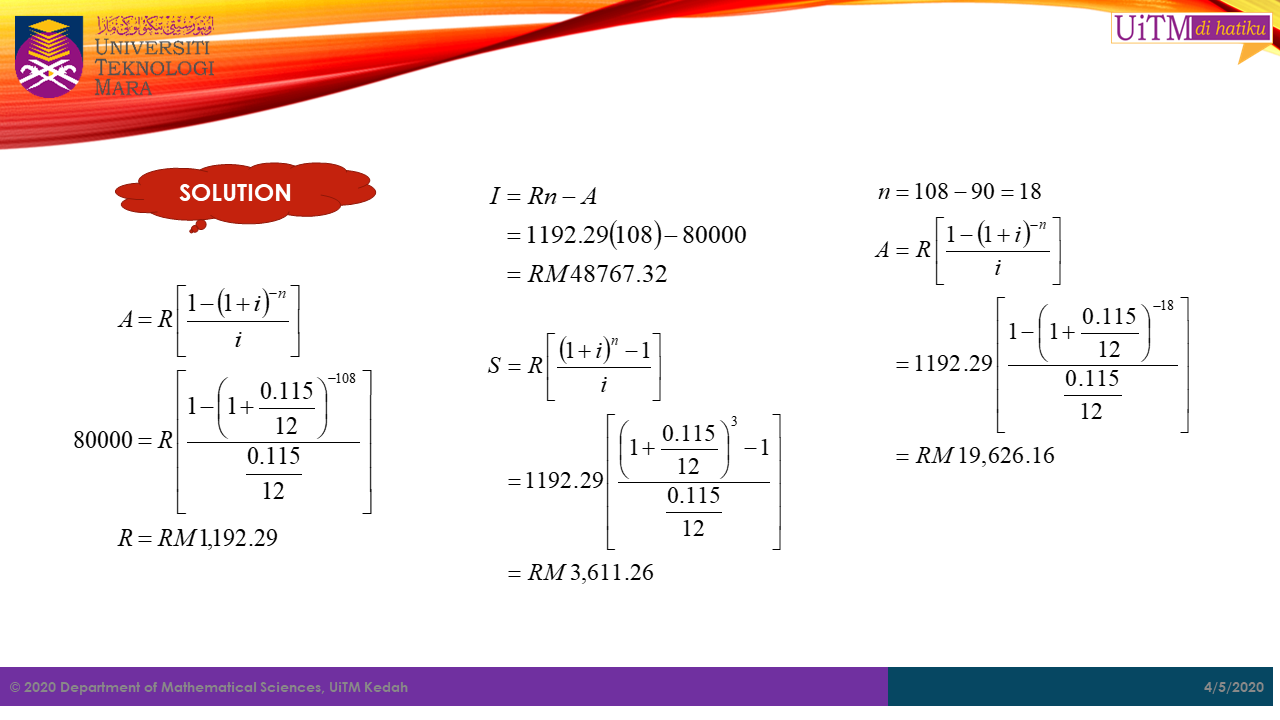

Application of Annuity

The application of annuity include the concept of taking a loan from a financial institution, purchasing item through instalment, etc.

Consider a scenario where you want to buy a house worth RM250,000 cash price from a house developer. Since you don’t have that much money, a bank offers a loan, 90% of the cash price at certain interest rate paid through equal payment for certain duration of time. Thus, in this case you will have to pay the developer 10% of the cash price as down payment, while the balance 90% will be paid by the bank to the developer for the remaining amount. All you need to do now is to repay the loan to the bank by instalment.

Here we have,

Down Payment (DP) = % x Cash Price (CP) = 10% x 250,000 = 25,000 Balance (A) = CP – DP = 250,000 – 25,000 = RM 225,000 <– This is the amount that you have to loan from a bank

Two (2) important comcepts to remember:

- When you have late payments –> use formula

- When you want to pay early –> use formula