Simple Interest

Ya Allah! Ampunilah dosa kami, dosa kedua ibubapa kami, dosa para pendidik dan murabbi yang telah membimbing kami ke jalan yang Kau redhai.

Aamiin Ya Rabbal’alamiin

Background

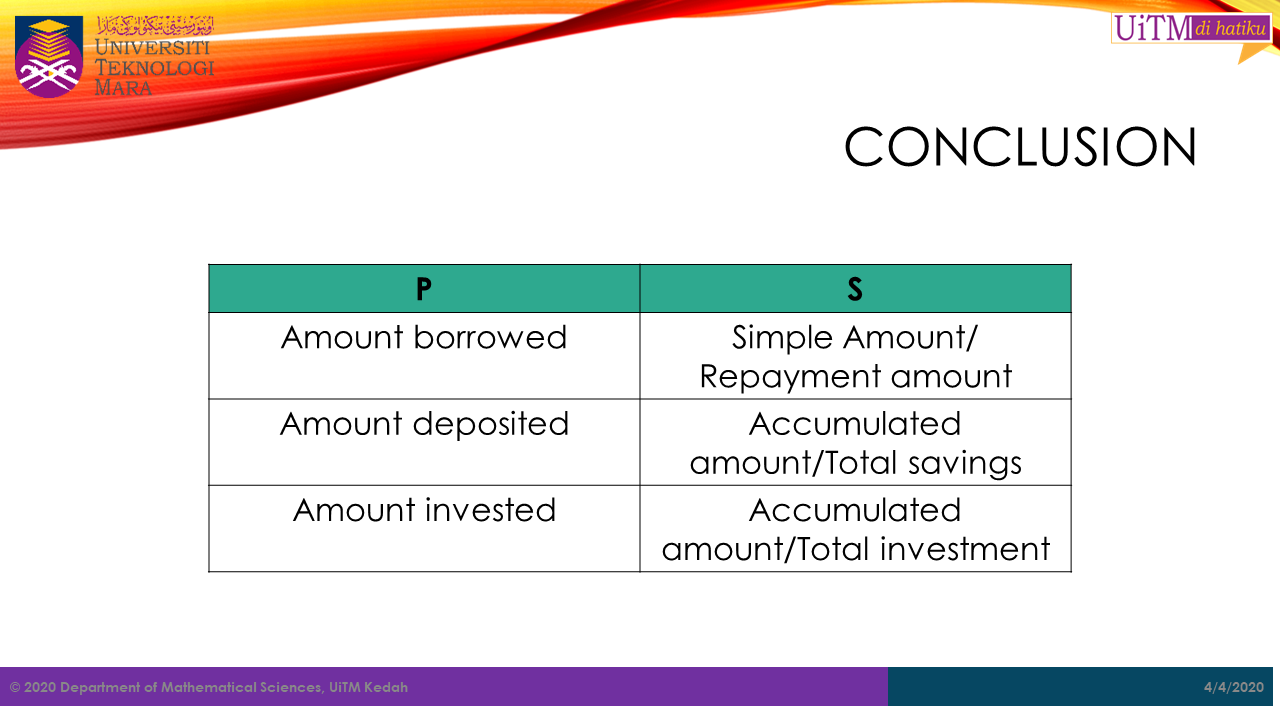

When we talk about interest, it can be in two scenarios whether you earned money from the certain amount of money you invested or you paid money for a certain amount of money you borrowed. Thus, interest can be defined as either money earned or paid from investment or loan amount made, respectively.

Simple interest is the interest due at the end of a term. In simple interest transaction, only the principal (original value) will earn the interest. The principal can be the amount of money deposited in an account or the amount of money borrowed.

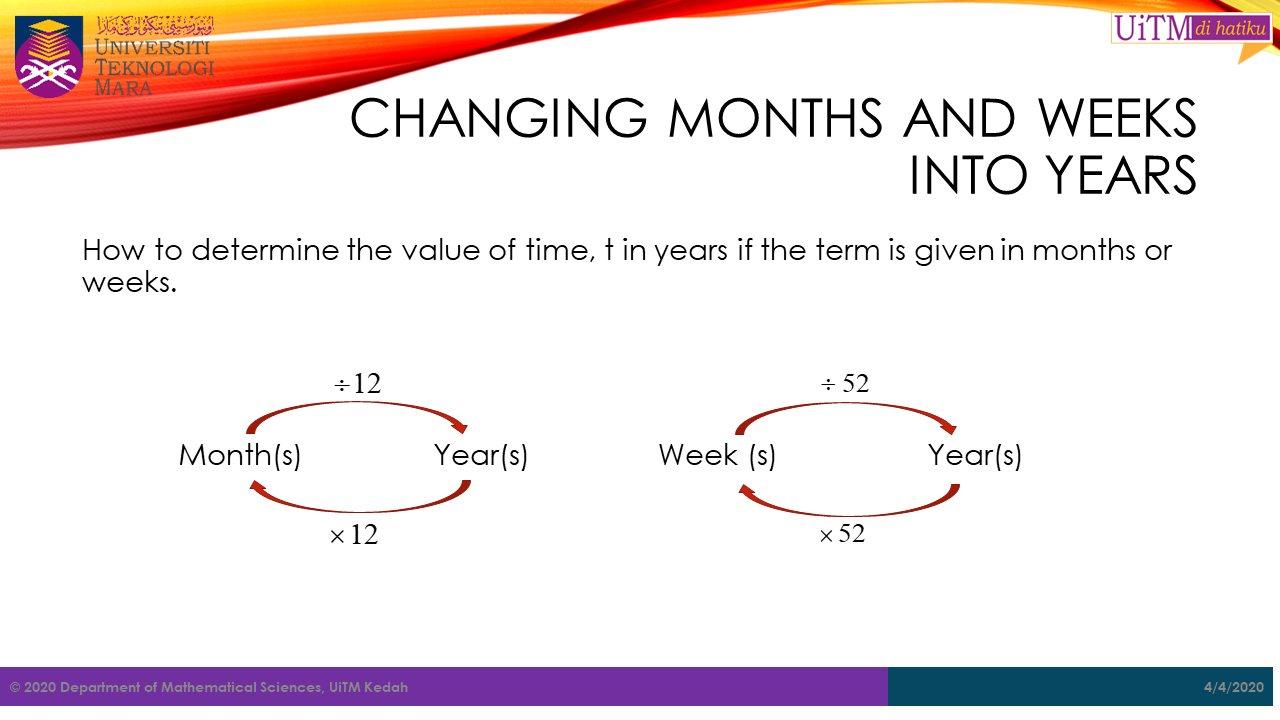

The amount of interest due at the end of a term depends on the principal, the length of the term and the rate of interest. The rate is usually given in percent and often as annual rate. The time is usually measured in years or a fraction of a year.

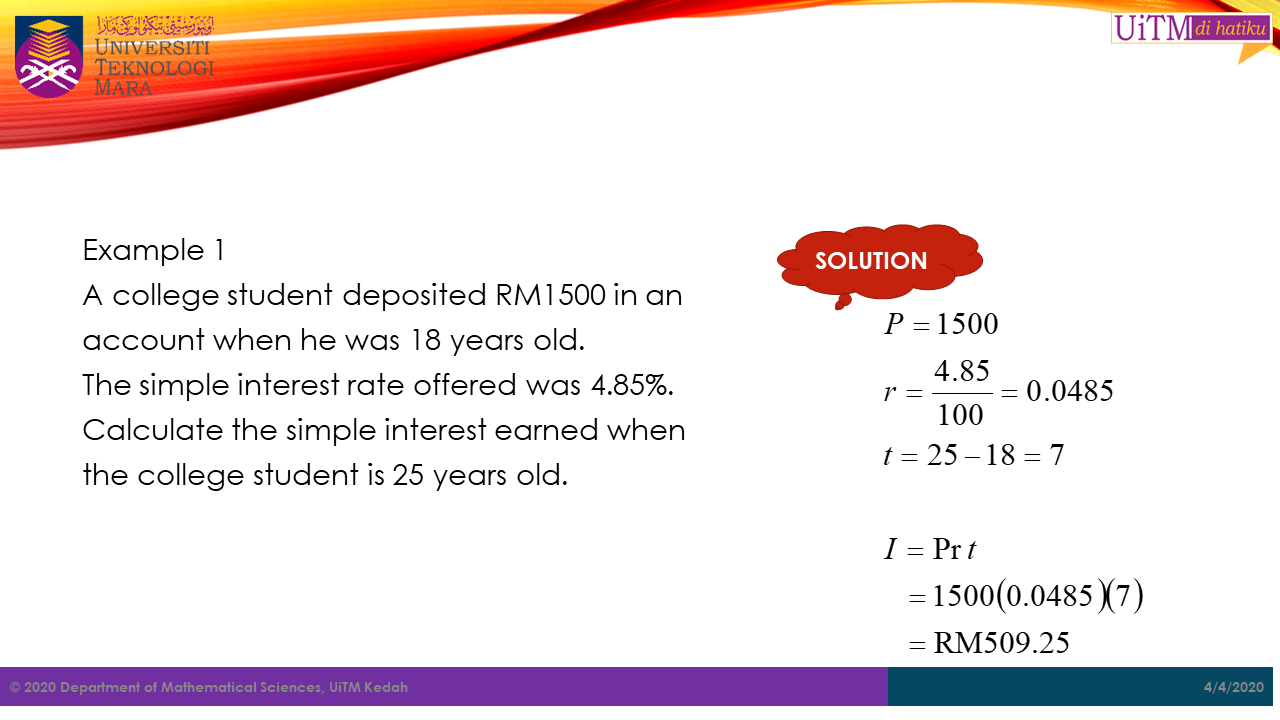

Simple interest formula

The formula to find the interest

In calculation,

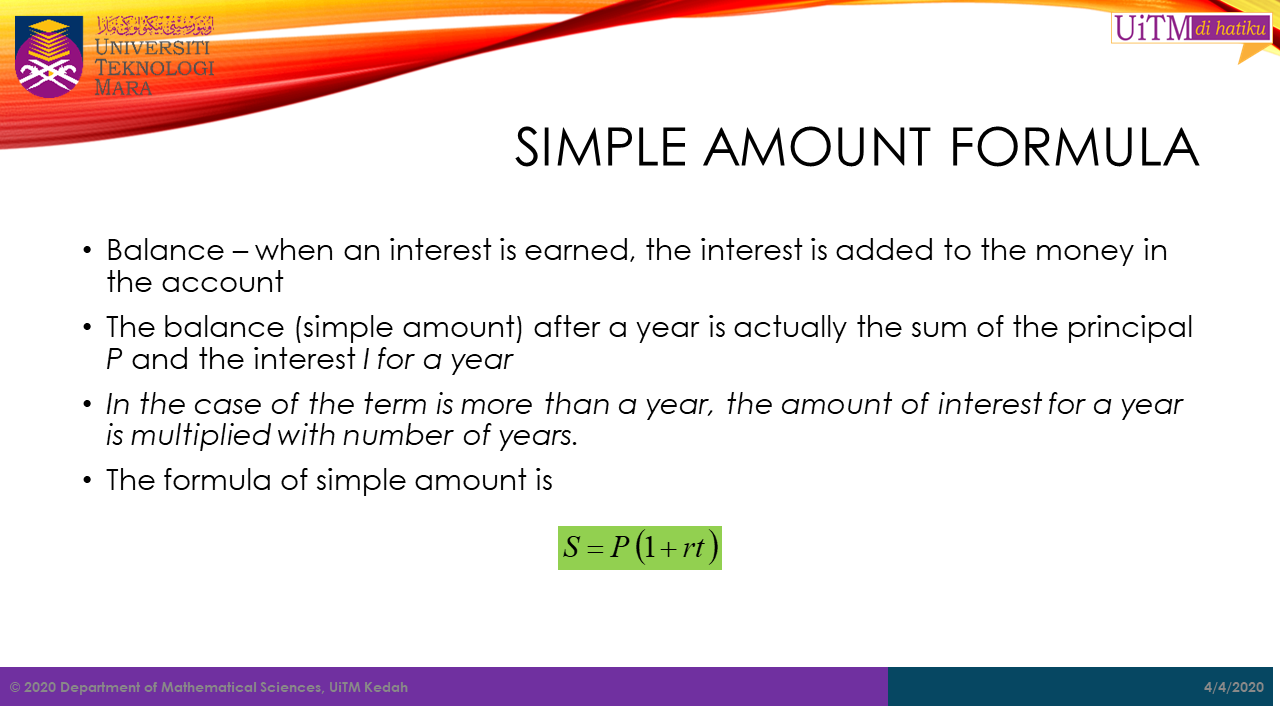

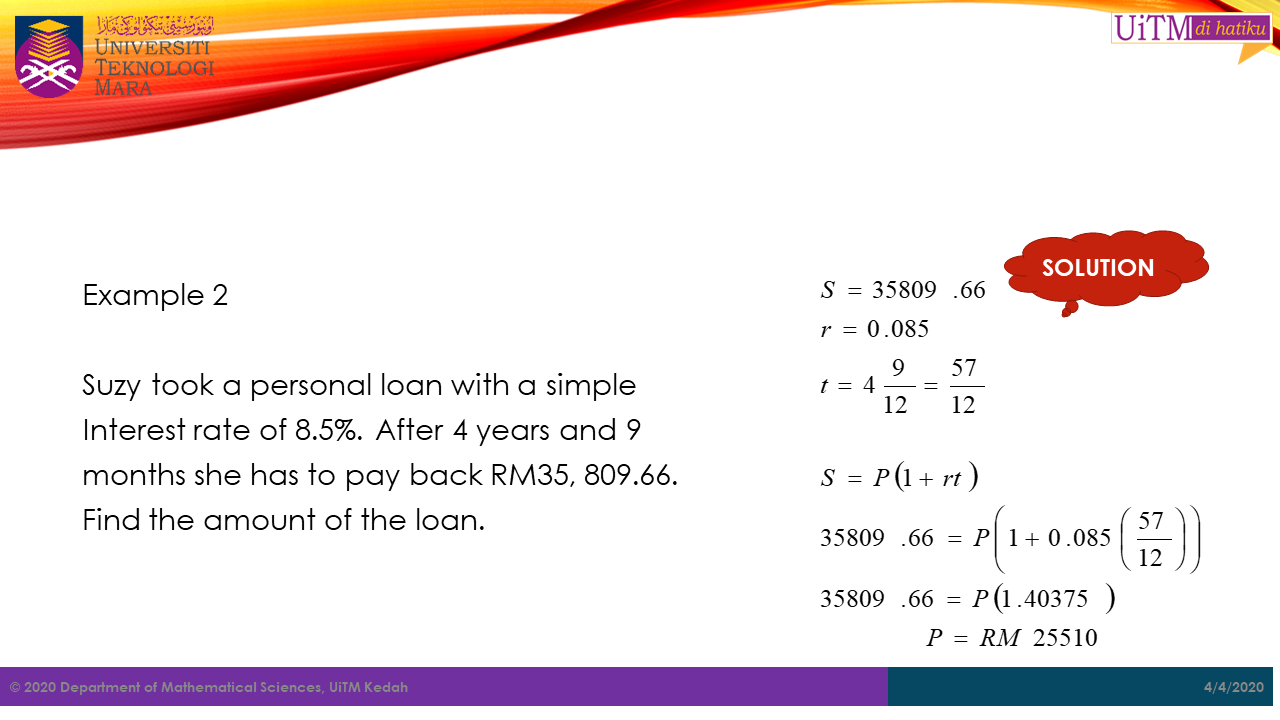

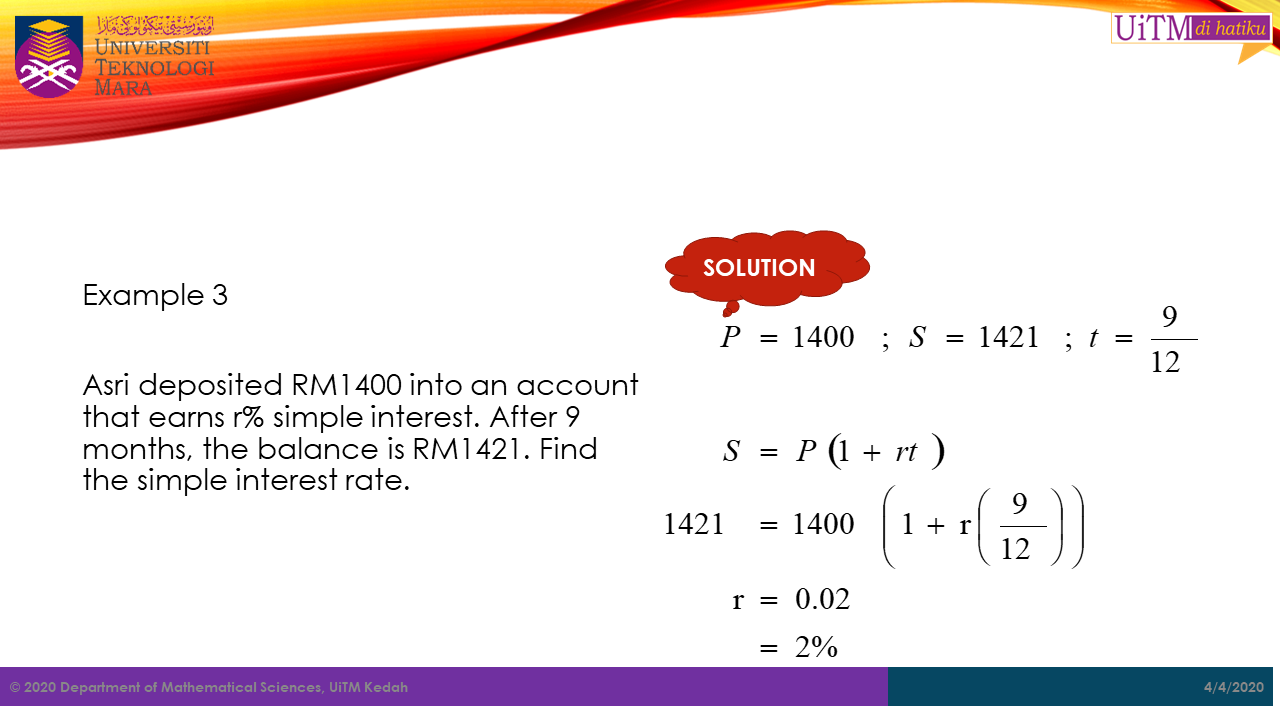

Simple amount formula

The future value

To find the simple amount

$$

Note: The value

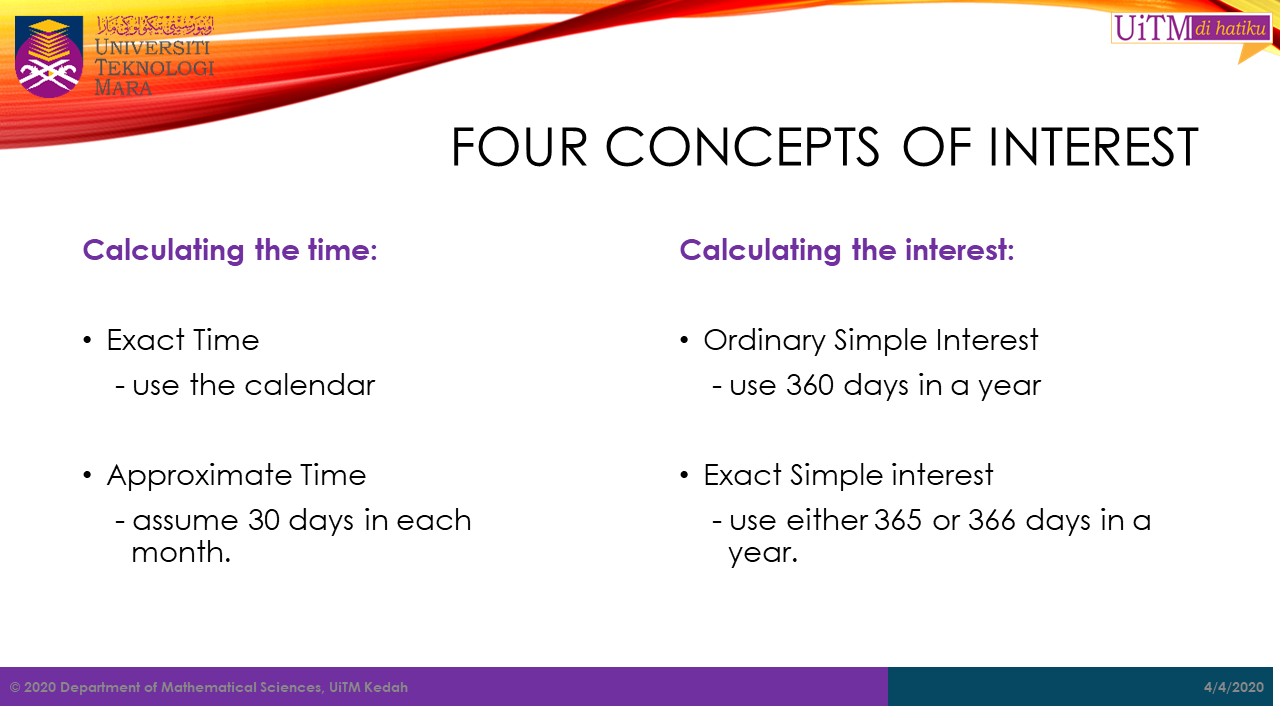

Four Basics Concepts of Interest

Sometimes the duration or term period is given in the form of the time between one date to another. For example, certain amount of money was invested in a mutual fund on

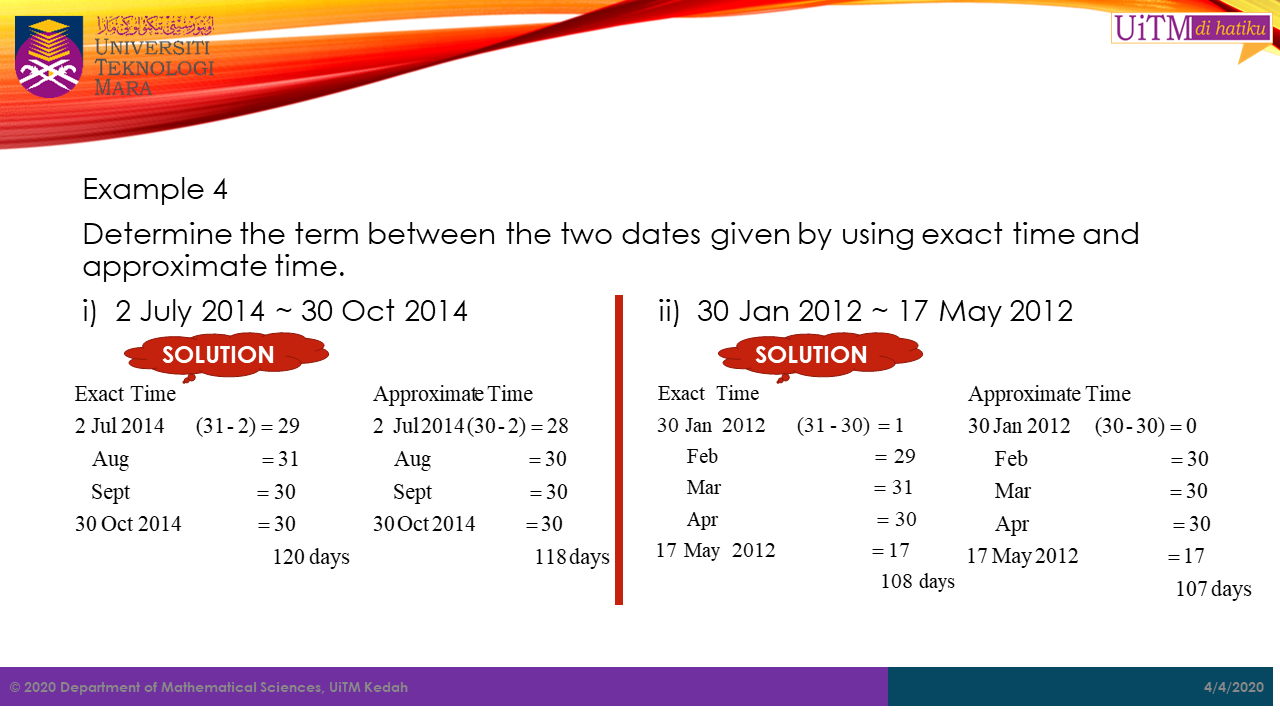

Exact time and approximate time

When dates are given, the number of days between the two dates is calculated in two ways. Those two ways are exact time and approximate time.

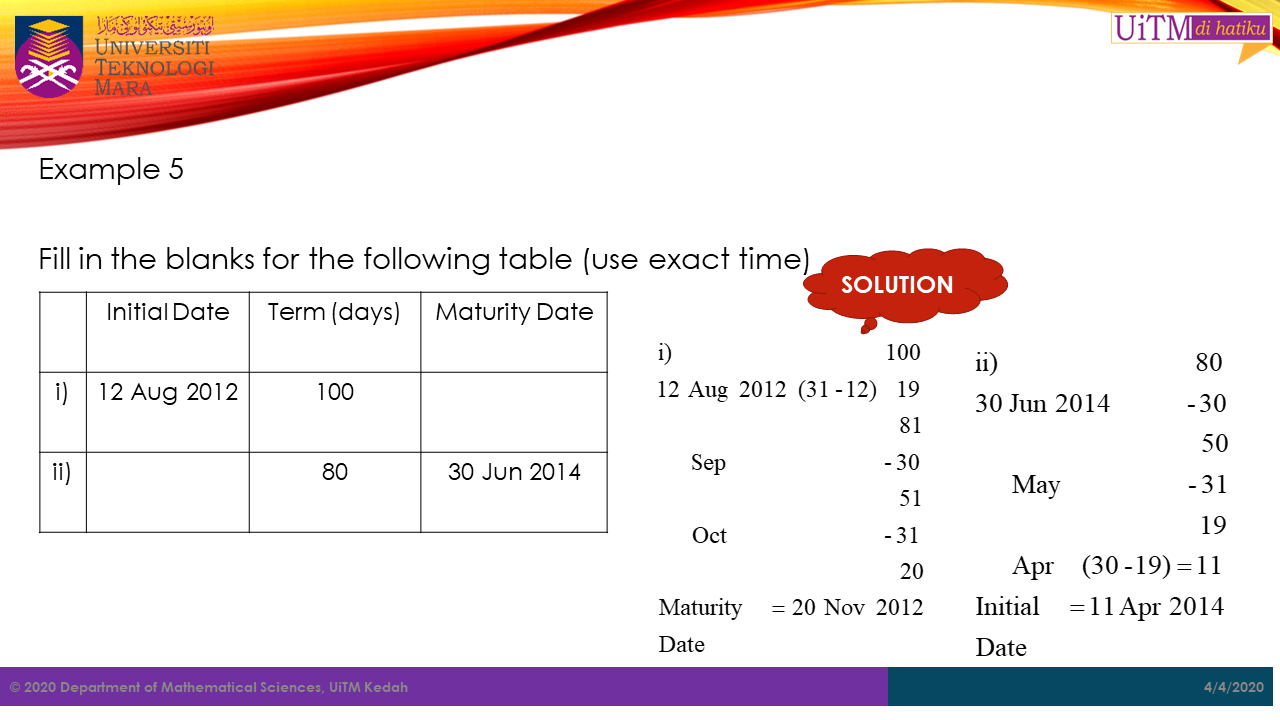

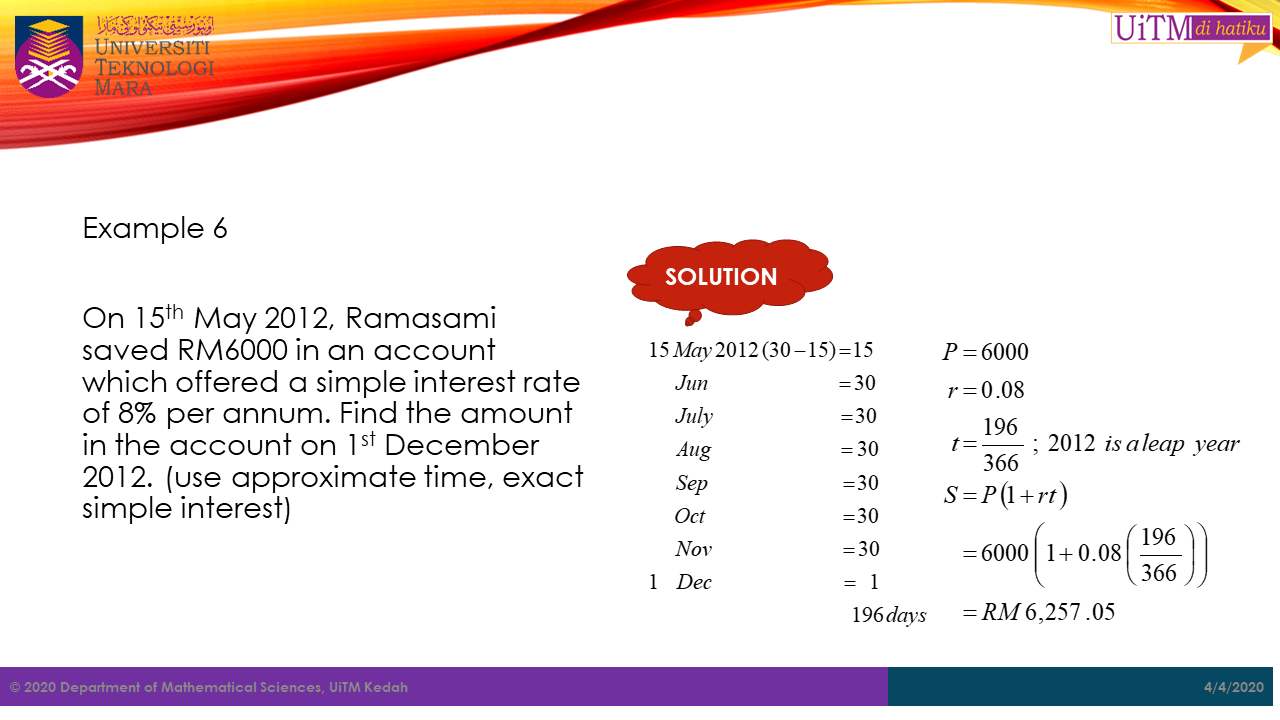

Exact time, as the name suggested, is the exact number of days as in the calendar between two dates given.

Approximate time is found by assuming each month is 30 days flat.

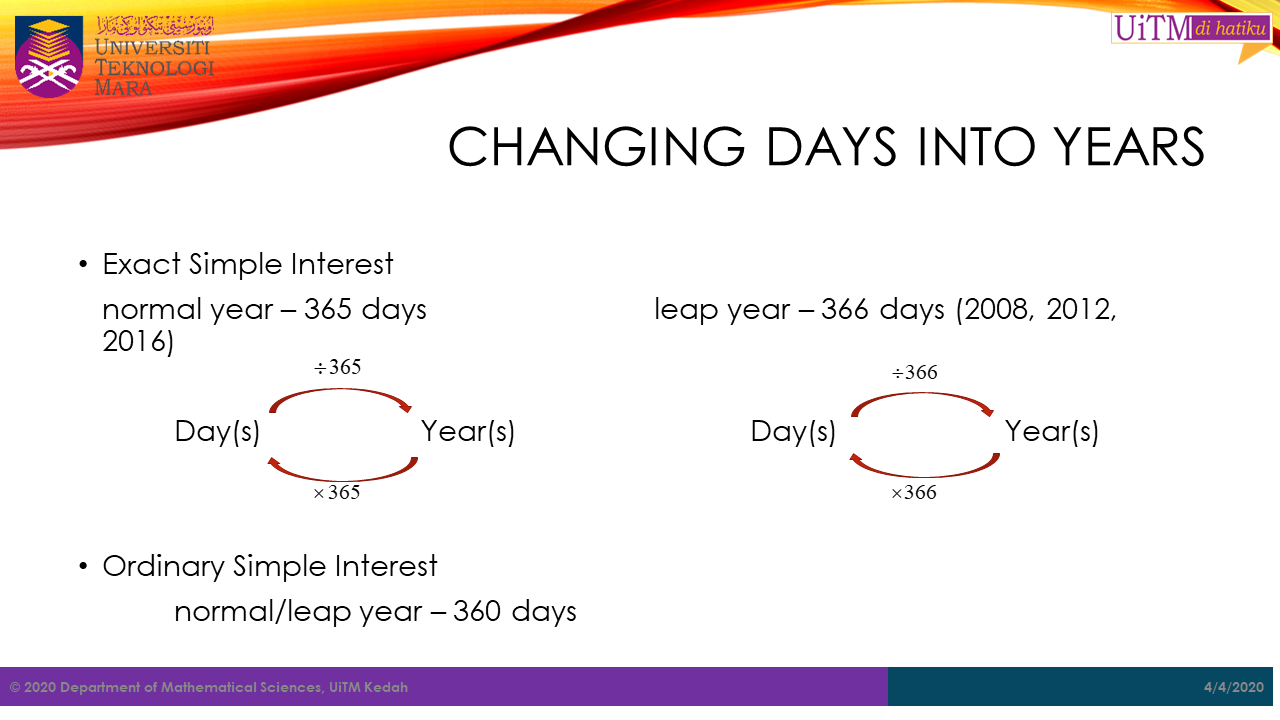

Ordinary simple interest and exact simple interest

There are two ways in which interest is calculated, namely the exact simple interest and the ordinary simple interest.

Exact interest is calculated based on 365 days a year, and for a leap year, using 366 days.

Ordinary interest is calculated using a 360 days a year. It is using an approximation that each month having 30 days. This is to simplify computing and of course it increases the amount of interest due to the lender.

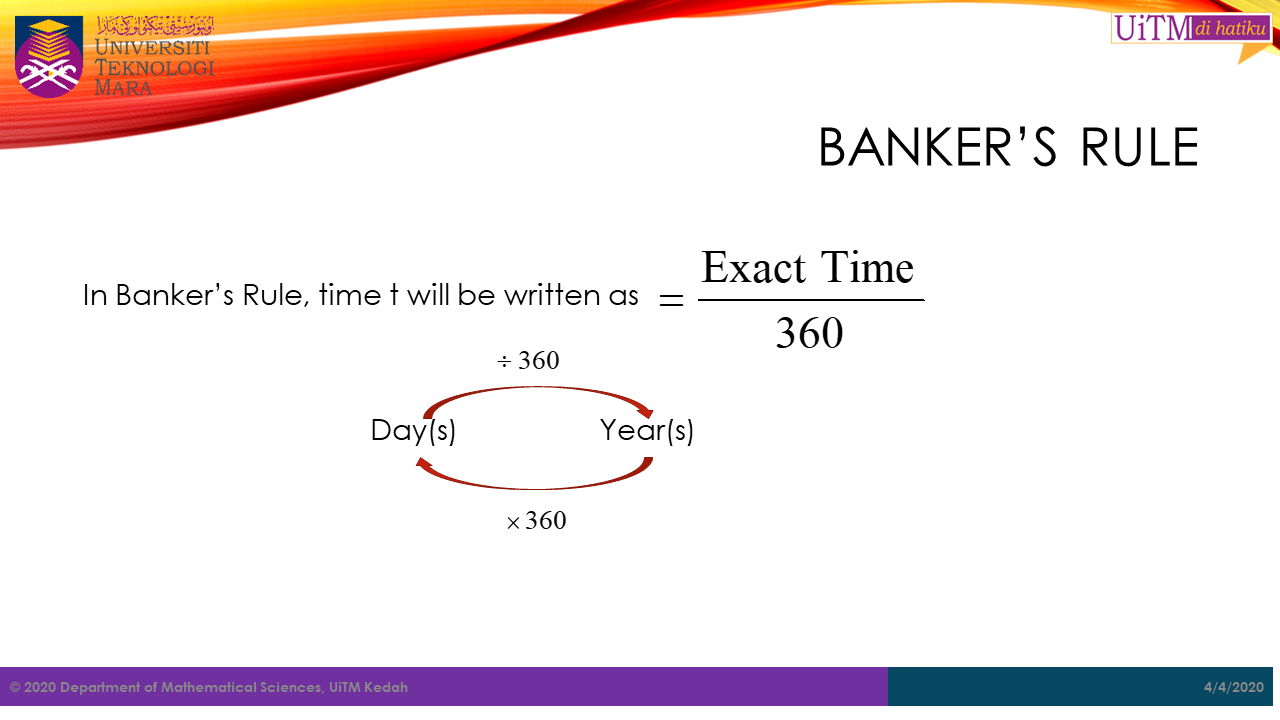

Banker’s Rule

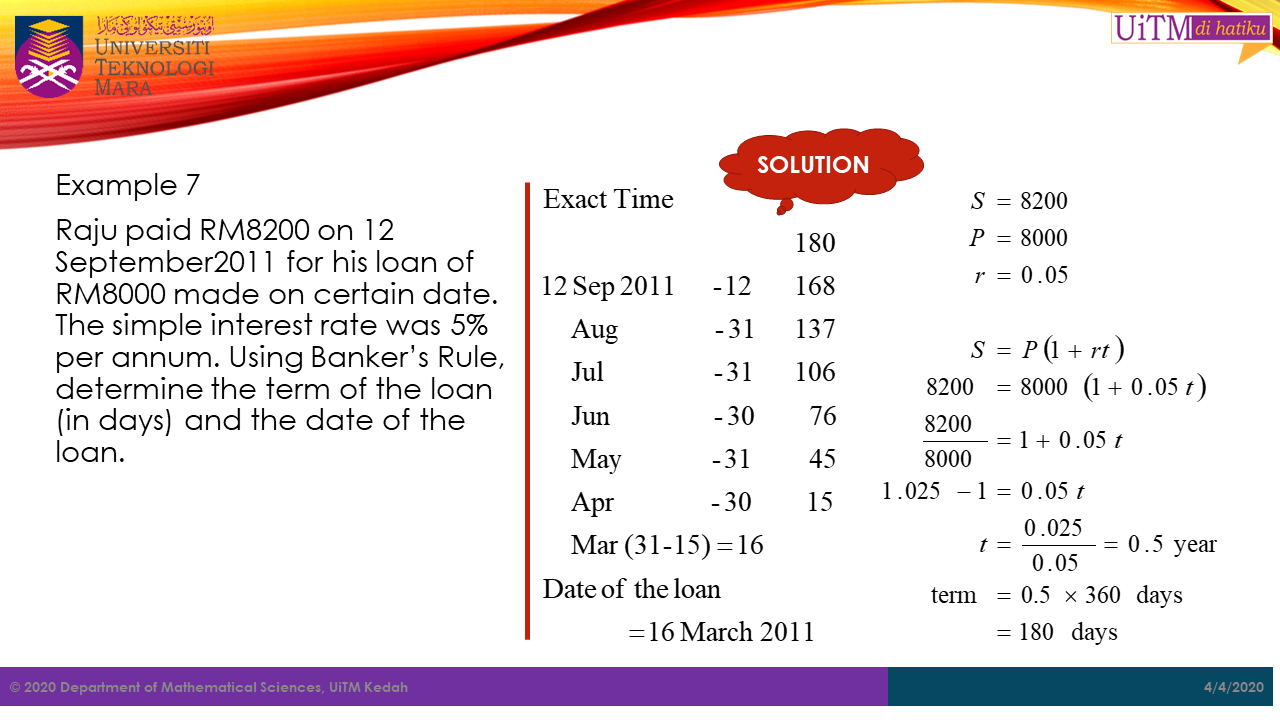

Of the four ways to compute simple interest, the most popular is that of ordinary interest for the exact number of days. Being the common practice of the bank, it is popularly known as the Banker’s Rule. Of the four methods, this yields the maximum interest in any transaction.

NOTE: Unless otherwise stated, we will use the Banker’s Rule in computing interest problems from here onwards.